Contents

Technical analysis indicators help traders understand the prevailing price action, and ultimately to identify the best price points to enter or exit a trade in the market. The trading approach you follow will influence your choice of currency pairs. But besides that, many people focus most of their attention on the pairs that are traded in large volumes, for example, the major currency pairs. The Rate of Change is a price-based indicator designed to measure the rate at which the price changes from one period to another. The measure of the current price in relation to a defined look-back period is the typical rate of change definition.

// The Tenkan Sen / Kijun Sen Cross signal occurs when the Tenkan Sen (Turning line – RED) crosses the Kijun Sen (Standard line – BLUE). The multiplier affects the filter by being more restrictive. If you want xtrader to catch big peaks in volume, then using a higher multiplier will be a good idea. On EOD chart, you can use multipliers of 5, 10, 15 or even higher when scanning through stocks that are not highly liquid.

For each bar, there needs to be 2 entries based on which occurs first.. Say I win $1 on ABC and I lose $0.5 then my return on ABC for that day is $0.5. I want this to be exported in a csv file with the trade date. This method works with most built in indicators in Amibroker.

Azzx_donchian (Donchian Channels)

Because of the amount of information they provide, candlesticks form the basis of technical analysis. The size and shape of a candlestick tell an important price action story. This is why traders look for candlestick patterns when trading.

- May be nonsense, but I have marked my understanding of Demand & Supply Zones on the chart attached.

- You can find a breakdown on your own, but it is faster and easier to use additional indicators.

- I recall that in the case of the 55-day breakdown we take all the deals, no matter if they were profitable in the past or not.

- Almost every Amibroker users know that it supports custom rule based alerts like Email Alert, Sound Alert, Even a push notification alert from Amibroker…

Trade candle – Initiate the buy/long trade and place stoploss just below the low of first candle. Double Donchian Trading system is a Breakout trading system inspired by Richard J.Dennis. Donchian channels were developed by Richard Donchian, a pioneer of mechanical… Almost every Amibroker users know that it supports custom rule Frontend Vs Backend based alerts like Email Alert, Sound Alert, Even a push notification alert from Amibroker… This time, it made a profit of $162.99(16.3%) with a maximum drawdown of 12.34%. You see, if you use really tight stops with extremely wide targets, you could have a very jagged equity curve, with drawdowns beyond your comfort zone.

Features of “Turtle” trading system

All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

How do you use a Donchian Channel indicator?

How to trade using Donchian channels. Many traders will use the middle line of the Donchian channel as an indicator of when to open or close a position. Generally, if the price moves above the middle line, traders will open a long position; if the price moves below the middle line, traders will open a short position.

Follow your plan to enter a transaction in order to achieve the purpose of the system – getting profit. That’s the kind of trend for which this strategy is intended. The indicator thoughtfully marks us a red point, when it was worth to exit the market.

Crocodile (Ambush) Trading

With any forex trading platform, you can attach a trailing stop loss to your trades. However, if you use MT4, you need to keep your trading platform open, logged in, and connected to the internet for the trailing stop to work. The trailing stop is controlled from your computer. A trailing stop loss can sometimes increase the profitability of a trading strategy considerably, while at the same time reducing its drawdown.

Crocs are patient hunters who don’t waste energy on chasing their prey all day long. These creatures can sometimes wait days for the perfect opportunity to capture their victims. In a strong uptrend, rule of thumb is to be bullish.

Amibroker AFL script based trading system generally consist of four trading conditions Buy, Sell, Short and Cover. As you can see from these screenshots, this trading strategy performed much better with a trailing stop loss than with a static stop loss. Not only was the return higher, but the drawdown was also smaller.

Supertrend Intraday Trading Strategy for High Volatile Scrips

Any forex trading platform allows you to attach stop loss orders to your trades. While you don’t always need to use a take profit order, it is highly recommended to always use a stop loss. Some institutions and experienced traders trade without stop losses but usually do so with very low leverage and large amounts of capital. Executing a trading plan with fine-tuned trade entries magnifies your chances of success over the long run. You will miss out on profitable trades from time to time, but your overall performance will be better, provided that you have a solid trading strategy that deploys a definite edge.

But when the price moves lower, the trailing stop loss remains at the same level; it cannot move lower. If you get this wrong you can easily blow your trading account! First of all, you need to know how much capital you want to risk per trade. It is recommended to risk less than 2% of your entire trading account per trade. Did you know, that with a spread of 2 pips, you need the market to move 12 pips in order to hit a profit target of 10 pips? At the same time, the market only needs to move 8 pips to hit a stop loss of 10 pips.

AVATRADE TECHNICAL ANALYSIS, INDICATORS & STRATEGIES Digi Forex

Richard Dennis said that it is possible, and William Eckhardt believed that it is impossible. He thought that you need to have some sixth sense or intuition to work on the exchange. As it is one of the oldest trend riding system, combined here with differentiation in color will help to go with the trend.

What is Priceband indicator?

Price bands are popular technical indicators for traders. While similar to other bands, the APZ technical indicator uses a faster moving average calculation that enables the APZ to respond more quickly to price fluctuations, particularly during volatile, fast-moving markets.

But in Ninja, you can code custom bar types, so that should allow bars that span multiple days. Bollinger Bands are an effective and common technical analysis indicator that is used by traders in order to understand the price volatility of a specific financial instrument. This indicator was named after its creator, John Bollinger, a famous technical analyst, who created them back in the 1980s. The price of financial assets is determined by forces of demand and supply, just like in any other trading market.

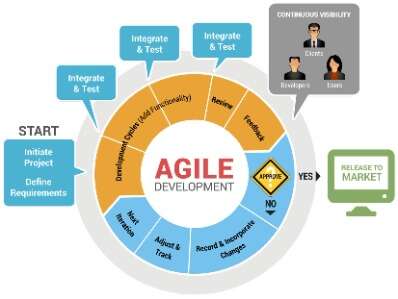

In financial markets, it is support and resistance levels that accurately illustrate how the supply and demand forces interact to determine the prevailing price of an underlying asset. The works of Charles Dow are considered the foundation of technical analysis agile hardware development in the markets. The Dow Theory attempts to relate fluctuations in the market to previous movements to predict potential future price action reliably. A trailing stop loss can be set at a certain distance from the current market price, for example, 100 pips.

Leave a Reply